AI Era Demands Modern Identity Verification for Banks

As digital transformation reshapes the banking and financial services (FS) , InsurTech and identity verification (IDV) has become a top priority. A seamless digital onboarding process is critical—often determining whether customers proceed or abandon a new relationship.

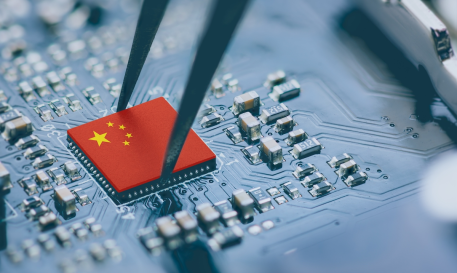

There is sharp rising sophisticated fraud tactics, particularly AI-driven deepfakes, and evolving regulatory demands make modern, secure, and scalable IDV solutions essential.

In The State of Identity Verification in the Financial Services Industry, we outline four key challenges facing FS firms:

1. Deepfakes Threaten Existing IDV Capabilities

With the rise of generative AI, face-swapping and synthetic identities are escalating. FS firms must invest in next-generation technologies like generative adversarial networks and multimodal sensing algorithms to strengthen deepfake detection and stay ahead.

2. Outdated Onboarding Hampers Growth

Slow, cumbersome IDV methods create friction and false positives, deterring legitimate customers and impacting conversion rates. Integrated, user-friendly IDV processes are necessary for smoother onboarding and continuous customer authentication.

3. Regulatory Complexity Increases Costs

New privacy laws, KYC, and anti-money-laundering regulations have heightened compliance burdens. FS firms need flexible, scalable IDV systems that adapt quickly to regulatory changes without ballooning costs.

4. Cost Management Becomes Crucial

Competitive pressures demand better customer acquisition strategies. Models like pay-per-IDV-check and multilayered verification systems can reduce operational costs and improve customer experience (UX).

Why a Multistakeholder Approach Matters

Effective IDV adoption requires collaboration across fraud prevention, customer experience, and compliance teams. Fraud teams focus on protecting against account takeovers; CX teams ensure verification processes are seamless; compliance officers monitor adherence to regulatory standards. A coordinated approach ensures robust, efficient, and user-friendly IDV deployments that support business growth.

Enhancing Every Stage of the IDV Lifecycle

Modern IDV solutions must be dynamic—optimizing verification paths, minimizing friction, and enhancing UX. Our report details key technologies banks should leverage at each lifecycle stage to boost verification accuracy and customer satisfaction.

In today’s environment, manual and legacy IDV processes are no longer sustainable. To remain competitive and resilient, FS firms must embrace modern IDV solutions that secure digital ecosystems, ensure compliance, and deliver exceptional customer experiences.