UPI Fraud: AI Tripwire in Works, Biometrics Urged

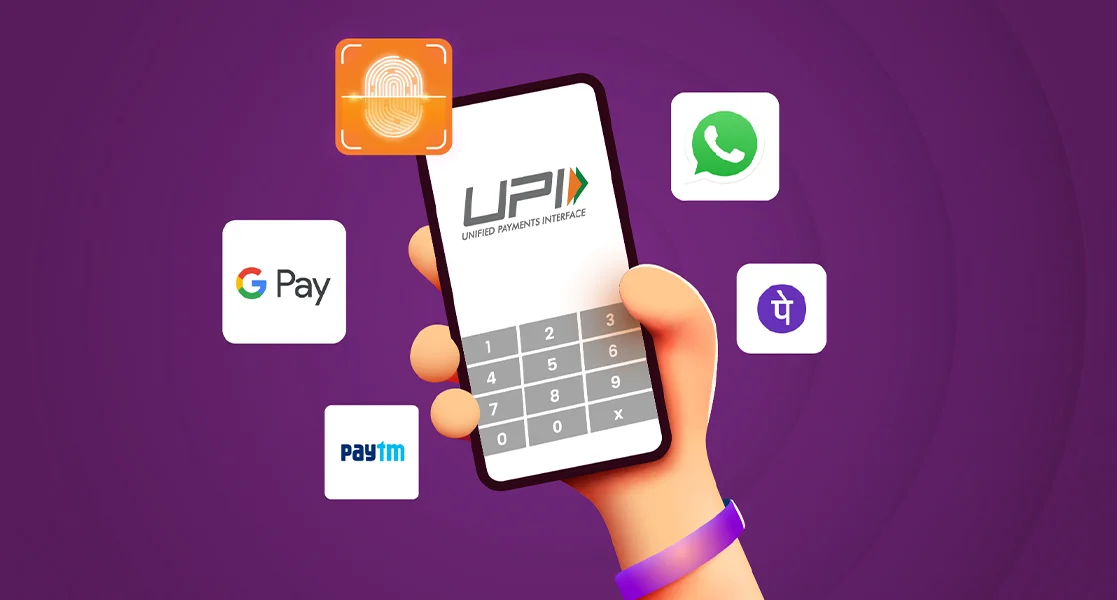

In a decisive move to curb the rising tide of digital payment fraud, the Indian government is joining forces with leading UPI apps like Google Pay, PhonePe, and Paytm to roll out a real-time fraud detection mechanism, dubbed the “payment tripwire.” This advanced system will introduce deliberate transaction delays, trigger fraud alerts, and prompt extra user confirmation for high-risk transfers.

With digital scams increasingly targeting less digitally literate users, officials say the goal is to bring all transactions—regardless of value—under tighter scrutiny, even at the cost of a few seconds' delay. The system uses artificial intelligence to assess behavioral and device-level indicators such as account age, contact history, past fraud flags, and unusual call or message patterns.

This initiative builds on the Financial Fraud Risk Indicator introduced by the Department of Telecommunications (DoT) as part of its Digital Intelligence Platform (DIP). Apps are already integrating DIP intelligence to assess transaction risk, with features like PhonePe’s “Protect” flagging or blocking suspicious transfers. Early feedback suggests improved fraud detection across platforms.

However, experts warn that AI and alerts alone may not suffice. A senior cybersecurity analyst recommends going a step further with behavioral biometric verification immediately after PIN entry. This approach would analyze unique user traits—like typing rhythm, finger pressure, and screen interaction—to add an almost impenetrable layer of security. “Such methods could make UPI transactions 99% secure against fraud,” the expert said.

As UPI now handles over 80% of India’s digital payments and fraud-related losses hit ₹36,014 crore in FY25, this next phase of real-time, intelligent, and user-centric protection may be key to safeguarding India’s digital economy.