Digital Scams Surge as UK Fraud Losses Hold at £1.17 Billion in 2024

UK Finance reports that fraudsters stole £1.17 billion in 2024, matching the previous year’s total. While authorised push payment (APP) fraud slightly declined, a sharp increase in remote purchase scams kept total losses high.

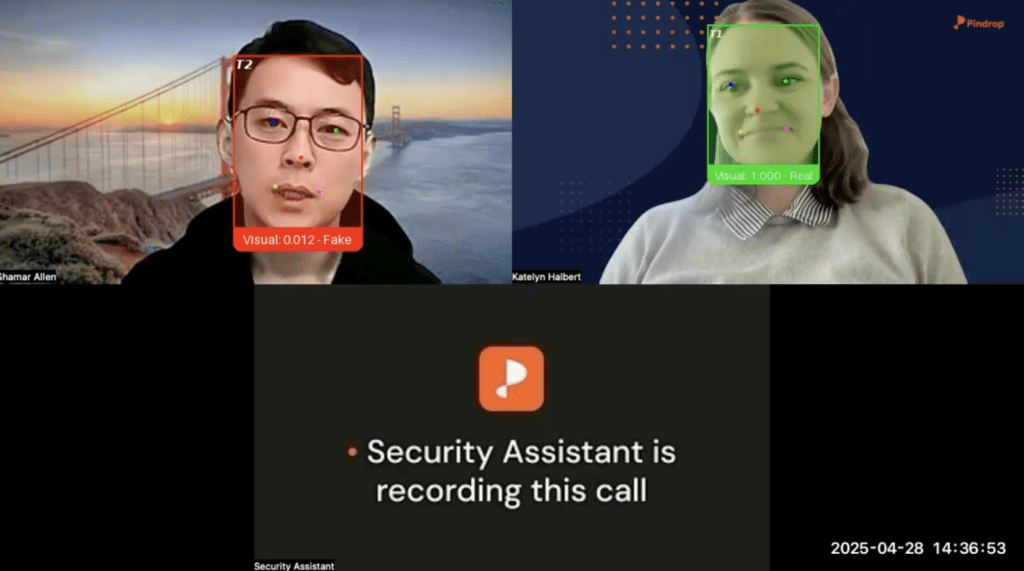

Unauthorised fraud cases rose 14% to 3.13 million, with losses reaching £722 million—a 2% uptick. Remote purchase fraud surged by 22%, now nearing 2.6 million cases, with financial losses increasing 11% to almost £400 million. This reverses prior downward trends and marks a return to high-risk territory for online and phone-based scams.

On a positive note, card ID theft and contactless fraud both declined, with the latter seeing its first drop since 2020. Remote banking fraud also fell, with losses down 7% and cases decreasing 17%.

APP fraud, often involving victims being deceived into transferring money, dropped by 2% in losses to £450.7 million. However, investment scams within this category surged 34% in value, despite a 24% drop in incidents, totaling £144.4 million stolen.

Ben Donaldson, MD of Economic Crime at UK Finance, urged stronger collaboration across sectors and demanded more accountability from tech and telecom firms in addressing fraud that originates on their platforms.